8 Mistakes That Could Delay Your Student Loan—it’s a real problem, fam. Like, seriously, student loans are a huge deal, and messing them up can totally throw off your whole future. This ain’t no joke, we’re talkin’ credit scores, future gigs, and all that. So, ditch the mistakes, stay on track, and keep your finances on point.

This guide breaks down eight common blunders that could delay your student loan repayment. From missed deadlines to poor planning, we’ll cover the lowdown on each error and how to avoid ’em. Get ready to level up your financial game, because knowledge is power, and this info is fire.

Understanding Student Loan Delays

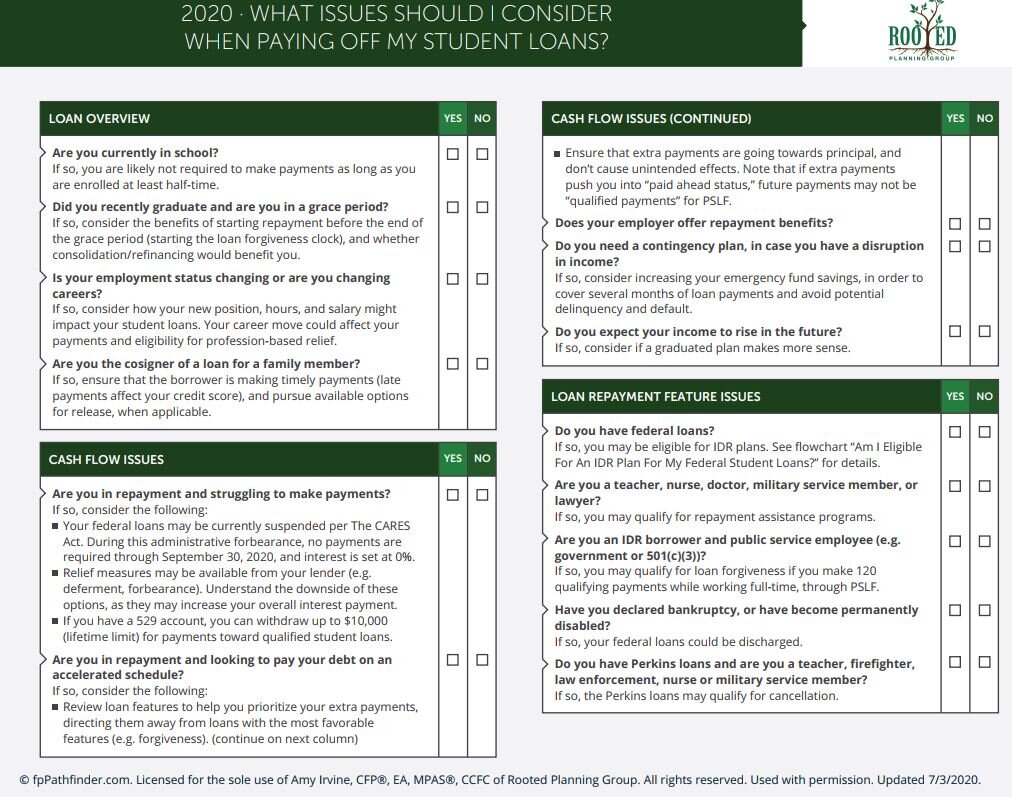

Student loan repayment is a crucial aspect of financial planning, and understanding potential delays is vital for maintaining financial stability. Delays can stem from unforeseen circumstances, impacting your credit score and future financial opportunities. This section explores the concept of student loan delays, the reasons behind them, the different types, and their consequences.Student loan delays, often unintentional, can arise from various life events or economic shifts.

These interruptions in the repayment schedule can significantly affect your financial well-being. Understanding the different types of delays and their implications is key to navigating these situations effectively.

Types of Student Loan Delays

Student loan delays generally fall into two primary categories: deferment and forbearance. These options provide temporary relief from repayment obligations, but they each have unique characteristics and implications.

Deferment

Deferment temporarily suspends your student loan payments. Eligibility often hinges on specific criteria, such as enrollment in an eligible degree program, economic hardship, or military service. This period of suspension typically lasts for a set duration, after which you resume payments, potentially with interest accruing during the deferment period. It is important to note that some federal student loans may have specific requirements and conditions that must be met for deferment to be granted.

Forbearance

Forbearance, unlike deferment, allows you to temporarily reduce or suspend your loan payments. It is often granted for reasons like significant financial hardship or unexpected medical expenses. During forbearance, interest typically continues to accrue, potentially increasing the overall loan amount. It’s important to understand that forbearance is not an automatic solution and usually requires formal application to the lender or loan servicer.

Impact on Credit Scores and Future Financial Stability

Delays in student loan repayment can negatively impact your credit score. Late payments or missed payments, even with a deferment or forbearance, can negatively affect your credit history. Consistent timely payments, even if reduced, contribute significantly to a strong credit score. A lower credit score can impact your ability to secure loans for various purposes in the future, including mortgages, car loans, and even rental applications.

Comparison of Deferment and Forbearance

| Feature | Deferment | Forbearance |

|---|---|---|

| Payment Suspension | Full payment suspension | Reduced or suspended payments |

| Interest Accrual | Generally, no interest accrual on federal loans | Interest continues to accrue |

| Eligibility Criteria | Specific circumstances (e.g., enrollment, economic hardship) | Broader range of circumstances (e.g., financial hardship, medical expenses) |

| Impact on Credit Score | Can be less impactful if handled correctly | Can negatively impact credit score if payments are missed or reduced |

| Duration | Usually for a set period of time | Can be for a set period or extended, dependent on individual circumstances |

Understanding the specific criteria and conditions for deferment and forbearance is crucial. Consulting with a financial advisor can provide tailored guidance and support in navigating these options.