Lack of Financial Planning and Budgeting

Failing to meticulously plan your finances is a frequent pitfall for student loan borrowers. Proactive budgeting and financial planning are cornerstones of successful loan repayment, enabling you to manage your resources effectively and avoid costly mistakes. Ignoring these crucial steps can significantly jeopardize your loan repayment journey, leading to delays and potentially higher interest charges.Poor financial planning often manifests in an inability to allocate sufficient funds for loan payments.

Without a structured budget, essential expenses might consume all available income, leaving little room for loan repayments, resulting in missed payments and ultimately loan delays. A well-structured budget, on the other hand, offers a roadmap for effective financial management.

Creating a Student Loan Repayment Budget

A well-defined budget is a critical tool for managing student loan repayments. It allows you to visualize your income and expenses, enabling informed financial decisions. This structured approach ensures that loan payments are prioritized alongside other essential expenses.Creating a student loan repayment budget requires a comprehensive understanding of your income and expenses. Start by meticulously listing all sources of income, including part-time jobs, scholarships, or any other financial aid.

Subsequently, itemize all your monthly expenses, categorizing them into essential (housing, utilities, food) and discretionary (entertainment, subscriptions). This detailed breakdown forms the bedrock of your budget.

Methods for Managing Unexpected Expenses

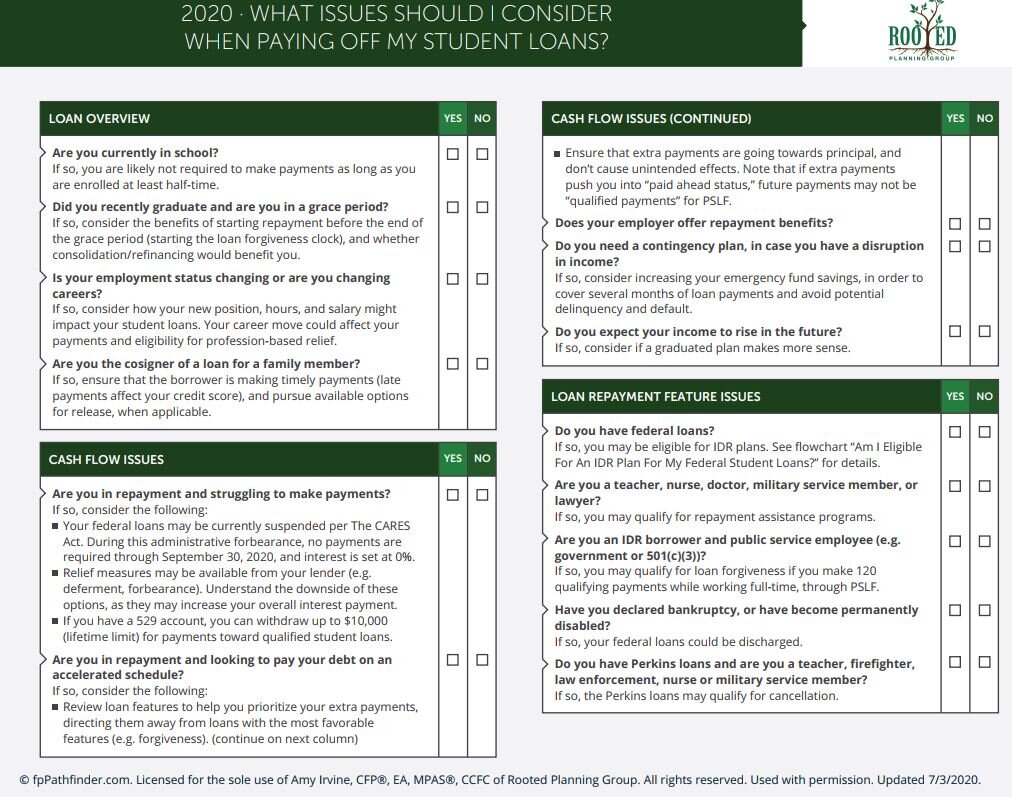

Unexpected expenses are inevitable, and proper financial planning includes strategies to mitigate their impact on student loan repayments. An emergency fund acts as a safety net, providing a buffer against unforeseen costs. Having this financial cushion can help maintain your loan repayment schedule even during challenging times.One effective strategy is to create a dedicated savings account for unexpected expenses.

Aim for at least three to six months’ worth of living expenses to ensure sufficient financial coverage. Another strategy involves reviewing and adjusting your budget periodically to accommodate unforeseen costs. Be adaptable and flexible with your budget, allowing for necessary adjustments. Remember to prioritize essential expenses while remaining mindful of your loan repayment commitments.

Sample Student Loan Repayment Budget Template

| Category | Income | Expenses | Student Loan Payment | Remaining Funds |

|---|---|---|---|---|

| Salary | $2,500 | Housing ($800), Utilities ($150), Food ($400) | $500 | $1,150 |

| Scholarship | $500 | Transportation ($100), Entertainment ($50) | $450 | |

| Total Income | $3,000 | $500 | $2,000 |

This template serves as a basic framework; customize it to fit your specific financial situation. Regular review and adjustments are essential to maintain the budget’s relevance and effectiveness. The budget template allows for tracking loan payments, income, expenses, and remaining funds. This structured approach enables you to effectively manage your finances and avoid loan delays.

Ignoring Important Notices and Communication

Failing to heed crucial communications from your student loan provider can lead to a cascade of unforeseen issues, potentially derailing your repayment journey. Ignoring these notices can have a detrimental impact on your credit score and can lead to costly penalties. Understanding the significance of each communication and establishing effective communication channels is paramount to avoiding such pitfalls.Effective communication management is key to a smooth student loan repayment experience.