Key Aspects of Loan Agreements

Understanding the specifics within a student loan agreement is paramount to effective financial management. A comprehensive review involves scrutinizing various components.

- Repayment Schedule: The repayment schedule details the due dates and amounts for loan payments. Understanding this schedule is critical to avoiding missed payments and accumulating late fees. It dictates the timing of payments and Artikels the implications of not adhering to the specified dates.

- Interest Rates: Interest rates significantly influence the overall cost of borrowing. A thorough understanding of the interest rate structure, whether fixed or variable, is vital. Comprehending the compounding nature of interest can help in anticipating the long-term financial burden of the loan.

- Default Procedures: Understanding the consequences of defaulting on a loan is crucial. The agreement will Artikel the specific actions that the lender will take in case of non-payment, including potential damage to credit history and legal recourse.

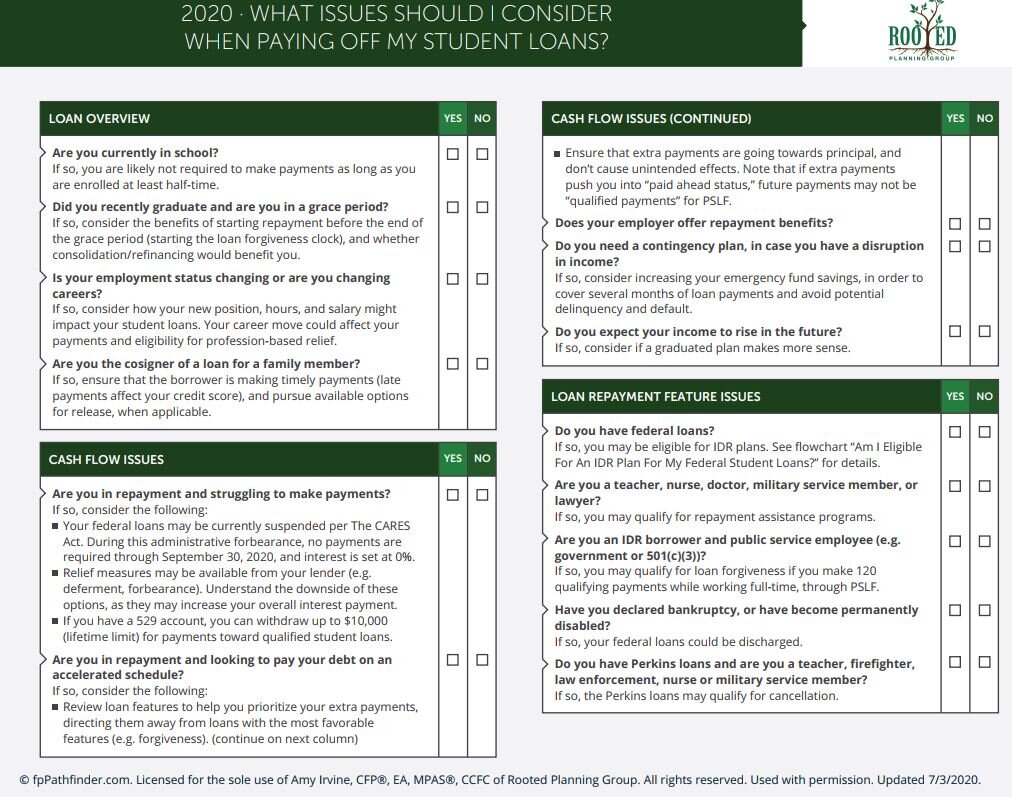

- Grace Periods: Many student loan programs offer grace periods before the repayment obligations begin. Understanding the grace period is vital to avoiding unintentional errors or penalties.

- Fees and Penalties: Loan agreements often include provisions for various fees and penalties, such as late payment fees, prepayment penalties, and origination fees. Thorough examination of these stipulations is essential for informed financial planning.

- Contact Information and Dispute Resolution Procedures: The agreement should clearly Artikel the lender’s contact information and the process for resolving any disputes or queries related to the loan.

Strategies for Understanding Complex Loan Documents

Effectively navigating complex loan documents requires proactive strategies.

- Seek Professional Advice: Consulting with a financial advisor or student loan specialist can provide invaluable insights and guidance in deciphering the intricacies of loan agreements.

- Break Down the Documents: Instead of tackling the entire document at once, break it down into smaller, manageable sections for more effective comprehension.

- Use Online Resources: Utilize online resources, such as educational websites and government publications, to gain a better understanding of student loan terminology and procedures.

- Ask Questions: Don’t hesitate to contact the lender or loan servicer directly with any questions or uncertainties regarding the loan agreement.

- Use a Spreadsheet or Financial Tool: Record key loan details in a spreadsheet or use a financial management tool to track payments and interest accrual. This can help visualize the loan’s trajectory and potential pitfalls.

Consequences of Not Understanding Loan Terms

The consequences of not understanding the terms of your student loan can be significant and far-reaching.

- Missed Deadlines and Late Fees: Failure to comprehend the repayment schedule can lead to missed payments, resulting in substantial late fees that can significantly increase the overall cost of the loan.

- Default and Damage to Credit History: Failure to meet loan obligations can lead to default, which severely damages credit history, making it challenging to secure future loans or credit facilities.

- Increased Interest Accrual: A lack of understanding about interest rates and their impact on the loan’s total cost can lead to increased interest accrual, resulting in a higher overall debt burden.

- Legal Action: Failing to understand and comply with loan terms can result in legal action from the lender, leading to further financial and personal consequences.

Choosing an Unrealistic Repayment Plan

Navigating the labyrinth of student loan repayment options can feel overwhelming. A critical factor in avoiding delays and ensuring a smooth financial path is selecting a repayment plan that aligns with your current and anticipated financial situation. A poorly chosen plan can lead to unforeseen hardship and prolonged debt.Choosing the right repayment plan is paramount to successfully managing your student loan obligations.

A carefully considered approach can significantly impact your long-term financial well-being, potentially preventing unnecessary stress and financial difficulties. Conversely, an ill-suited plan can lead to missed payments, escalating interest charges, and a protracted repayment period.

Repayment Plan Options

Different repayment plans offer varying payment structures, impacting your monthly obligations and overall repayment timeline. Understanding these options is crucial for making an informed decision.

- Standard Repayment Plan: This plan typically involves a fixed monthly payment calculated based on a 10-year repayment period. While straightforward, it might prove challenging for individuals experiencing financial hardship or anticipating future income fluctuations. The fixed monthly payment can sometimes be insufficient to address a borrower’s evolving financial circumstances.

- Graduated Repayment Plan: This plan starts with a lower monthly payment that gradually increases over time. It offers a more manageable initial payment for those anticipating future income growth or temporary financial constraints. However, the higher payments later on might create difficulty in maintaining consistent repayment if unexpected financial setbacks occur.

- Income-Driven Repayment Plans: These plans base your monthly payment on your income and family size. They provide significant relief during periods of low or fluctuating income, but they can lead to a longer repayment term and potentially higher overall interest costs over the life of the loan. The exact amount and conditions of income-driven plans are often subject to federal regulations and may differ from year to year.

Factors to Consider When Selecting a Repayment Plan

Several factors should influence your choice of repayment plan. Thorough consideration of these elements can prevent a costly and potentially damaging mistake.