Student loan calculator tools, loan EMI calculator apps offer a powerful way for prospective and current students to navigate the complexities of student loan repayment. These tools provide easy access to a variety of functionalities, enabling users to compare different loan options and understand their potential financial commitments. From fixed-rate to variable-rate loans, and loan payoff calculators, these resources empower informed financial decisions.

The accuracy and reliability of these calculators are paramount, and users should be aware of potential pitfalls and verification methods.

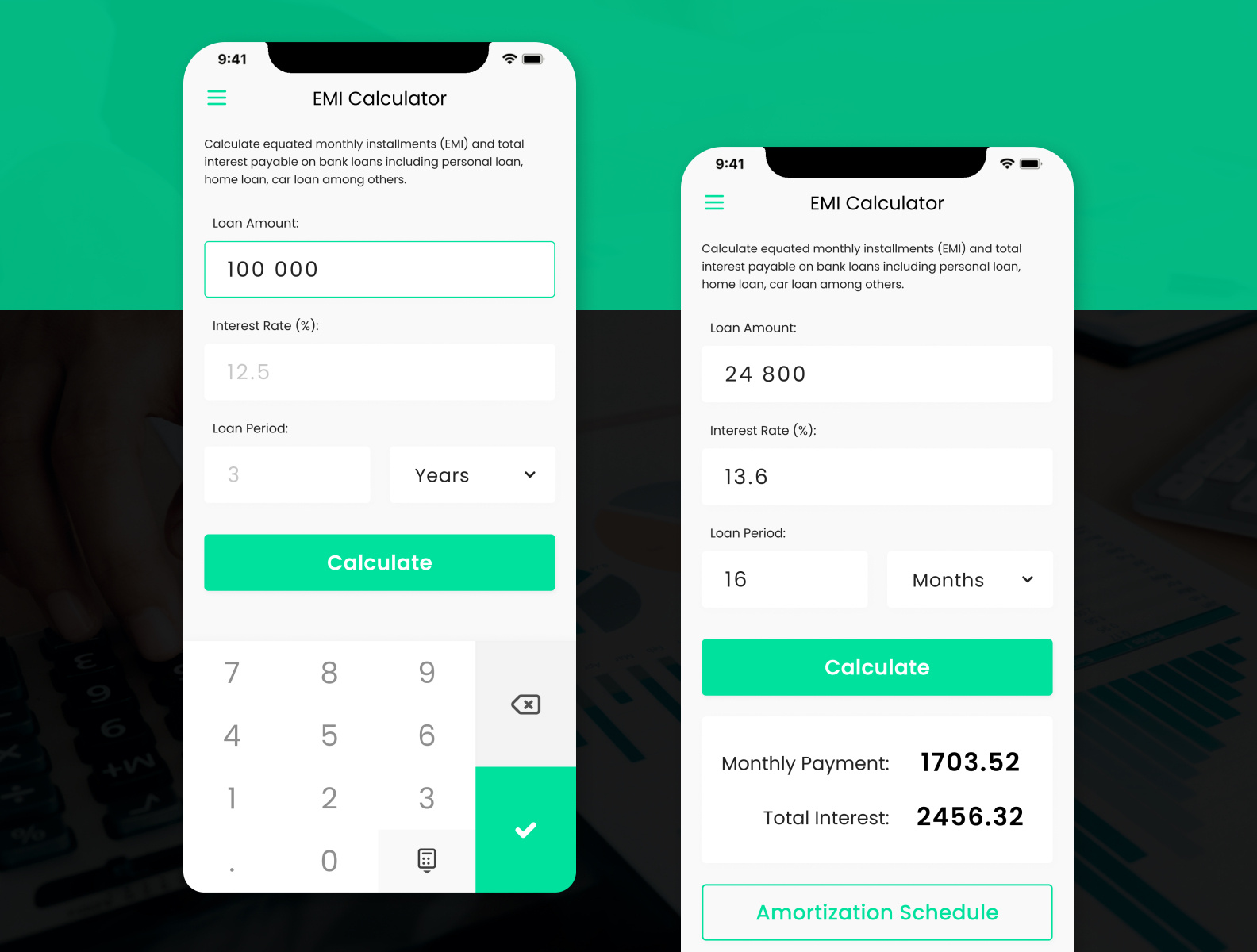

Understanding the different features and functionalities of these tools is crucial. Loan EMI calculators and apps typically calculate monthly payments based on input parameters like loan amount, interest rates, and loan terms. These tools often allow comparisons of various loan options, enabling users to weigh the advantages and disadvantages of each. Navigating the user interface effectively and understanding the different repayment options available is key to maximizing the tool’s potential.

Introduction to Student Loan Calculators

Student loan calculators are powerful tools that help prospective and current students navigate the complexities of financing their education. They provide a clear picture of potential loan costs, repayment schedules, and overall financial impact. These calculators are invaluable resources for making informed decisions about borrowing and managing student loan debt effectively.Understanding the various features and functionalities of these calculators empowers students to optimize their borrowing strategies and plan for a successful future.

By simulating different scenarios, students can assess the long-term implications of various loan options and develop realistic financial plans.

Types of Student Loan Calculators

Student loan calculators come in various forms, catering to different needs and situations. These tools vary in their complexity and features, allowing users to simulate a range of scenarios. Fixed-rate calculators, for example, calculate repayments based on a predetermined interest rate, providing a straightforward view of monthly payments and total loan costs. Variable-rate calculators, on the other hand, account for fluctuating interest rates, allowing users to see how changing rates affect their repayment obligations.

Loan payoff calculators are specifically designed to estimate the time it takes to pay off a student loan, considering factors such as interest rates and monthly payments.

Key Features of Student Loan Calculators

Accurate and reliable student loan calculators are crucial for informed decision-making. The calculators should incorporate essential factors such as interest rates, loan terms, and repayment options. The accuracy of the calculations directly impacts the user’s understanding of the financial implications of their choices. Reliability ensures that the results are consistent and trustworthy, allowing for realistic projections of loan costs.

| Feature | Description | Importance |

|---|---|---|

| Interest Rates | The percentage charged on the borrowed amount. | Crucial for determining the total cost of the loan. |

| Loan Terms | The duration of the loan (e.g., 10, 15, 20 years). | Impacts the length of the repayment period and the total interest paid. |

| Repayment Options | Different ways to repay the loan (e.g., fixed monthly payments, graduated payments, income-driven repayment). | Allows users to select a repayment plan that aligns with their financial capacity. |

| Fees | Any additional charges associated with the loan (e.g., origination fees, late payment fees). | Adds to the overall cost of the loan. |

Comparison of Loan Calculator Features

Different loan calculators offer varying levels of detail and features. Comparing calculators allows users to select the tool that best suits their needs. A key comparison is the ability to adjust different variables, such as interest rates and repayment periods. This allows users to see how different choices impact their monthly payments and overall loan costs.