Student loan calculator tools, loan EMI calculator apps offer a powerful way for prospective and current students to navigate the complexities of student loan repayment. These tools provide easy access to a variety of functionalities, enabling users to compare different loan options and understand their potential financial commitments. From fixed-rate to variable-rate loans, and loan payoff calculators, these resources empower informed financial decisions.

The accuracy and reliability of these calculators are paramount, and users should be aware of potential pitfalls and verification methods.

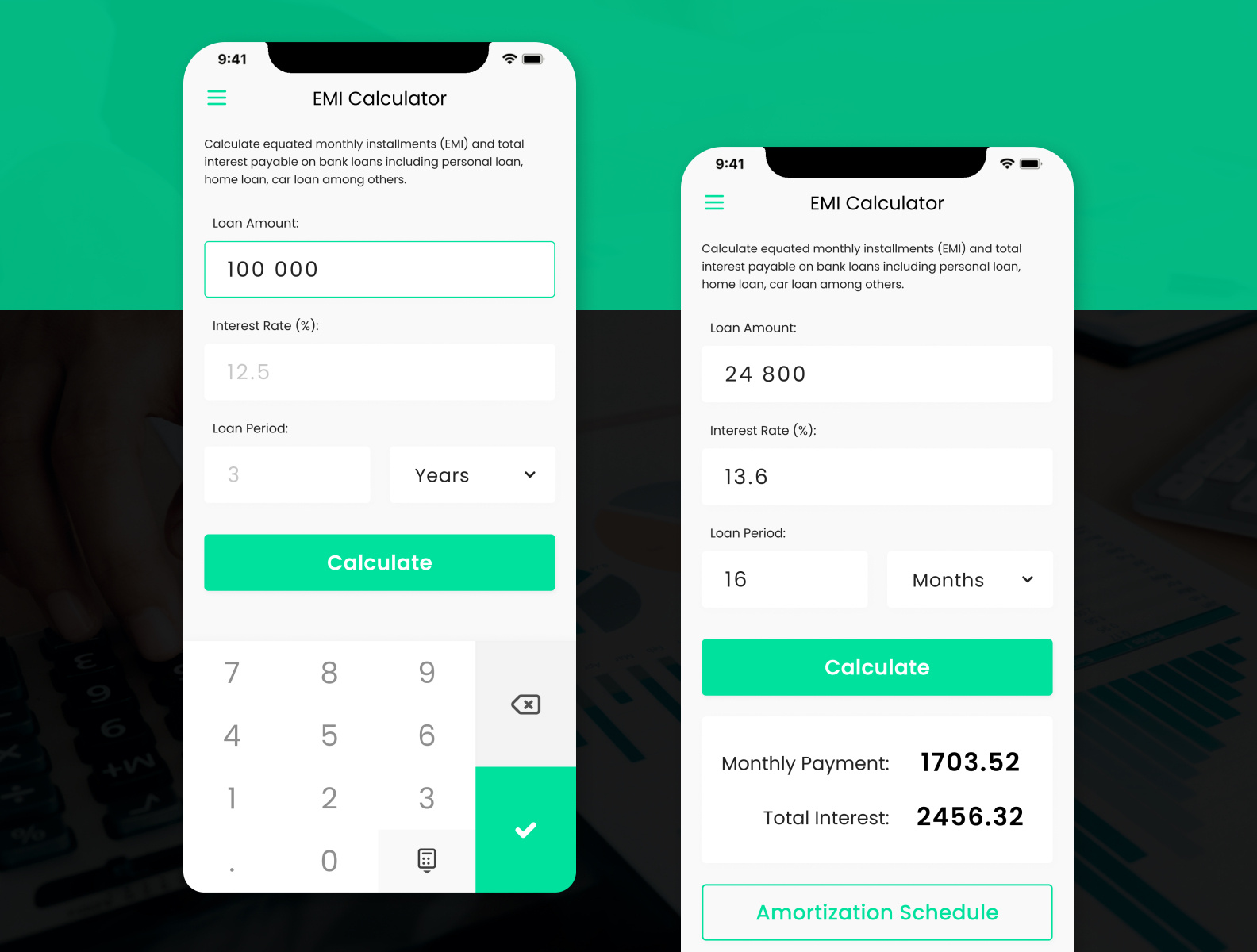

Understanding the different features and functionalities of these tools is crucial. Loan EMI calculators and apps typically calculate monthly payments based on input parameters like loan amount, interest rates, and loan terms. These tools often allow comparisons of various loan options, enabling users to weigh the advantages and disadvantages of each. Navigating the user interface effectively and understanding the different repayment options available is key to maximizing the tool's potential.

Introduction to Student Loan Calculators

Student loan calculators are powerful tools that help prospective and current students navigate the complexities of financing their education. They provide a clear picture of potential loan costs, repayment schedules, and overall financial impact. These calculators are invaluable resources for making informed decisions about borrowing and managing student loan debt effectively.Understanding the various features and functionalities of these calculators empowers students to optimize their borrowing strategies and plan for a successful future.

By simulating different scenarios, students can assess the long-term implications of various loan options and develop realistic financial plans.

Types of Student Loan Calculators

Student loan calculators come in various forms, catering to different needs and situations. These tools vary in their complexity and features, allowing users to simulate a range of scenarios. Fixed-rate calculators, for example, calculate repayments based on a predetermined interest rate, providing a straightforward view of monthly payments and total loan costs. Variable-rate calculators, on the other hand, account for fluctuating interest rates, allowing users to see how changing rates affect their repayment obligations.

Loan payoff calculators are specifically designed to estimate the time it takes to pay off a student loan, considering factors such as interest rates and monthly payments.

Key Features of Student Loan Calculators

Accurate and reliable student loan calculators are crucial for informed decision-making. The calculators should incorporate essential factors such as interest rates, loan terms, and repayment options. The accuracy of the calculations directly impacts the user's understanding of the financial implications of their choices. Reliability ensures that the results are consistent and trustworthy, allowing for realistic projections of loan costs.

| Feature | Description | Importance |

|---|---|---|

| Interest Rates | The percentage charged on the borrowed amount. | Crucial for determining the total cost of the loan. |

| Loan Terms | The duration of the loan (e.g., 10, 15, 20 years). | Impacts the length of the repayment period and the total interest paid. |

| Repayment Options | Different ways to repay the loan (e.g., fixed monthly payments, graduated payments, income-driven repayment). | Allows users to select a repayment plan that aligns with their financial capacity. |

| Fees | Any additional charges associated with the loan (e.g., origination fees, late payment fees). | Adds to the overall cost of the loan. |

Comparison of Loan Calculator Features

Different loan calculators offer varying levels of detail and features. Comparing calculators allows users to select the tool that best suits their needs. A key comparison is the ability to adjust different variables, such as interest rates and repayment periods. This allows users to see how different choices impact their monthly payments and overall loan costs.

Functionality and Features of Loan Calculators

Student loan calculators and apps have become indispensable tools for aspiring students and those already in debt. These tools simplify the often complex process of understanding and managing student loan repayments. Beyond simply providing a figure, the best calculators offer insights into various repayment strategies, empowering users to make informed decisions.Loan calculators go beyond basic EMI calculations. They often provide a comprehensive overview of the loan, including the total interest paid, the total amount repaid, and projections for the entire loan tenure.

This allows users to effectively compare different loan options, factors like interest rates, and loan terms.

Common Functionalities of Loan EMI Calculators

Loan EMI calculators typically calculate monthly payments based on the principal loan amount, interest rate, and loan tenure. The fundamental calculation involves a complex formula that considers compounding interest over time. This means the interest charged on the loan changes as the loan is repaid. The most commonly used formula for calculating monthly EMI is the following:

EMI = [P x R x (1+R)^N]/[(1+R)^N-1]

Where:

- P = Principal loan amount

- R = Monthly interest rate (annual interest rate divided by 12)

- N = Total number of monthly installments

Calculation Methodology

The calculations behind loan EMI calculators are built on the concept of amortized loans. This means the loan amount is repaid in equal installments over a set period, and each installment covers both interest and principal repayment. The interest component of each EMI is calculated on the outstanding principal balance. As the loan is repaid, the outstanding principal balance decreases, and the interest component of subsequent EMIs also decreases.

Input Parameters

These calculators require specific input parameters to function correctly. The key inputs include:

- Principal Loan Amount: The total amount borrowed.

- Interest Rate: The annual interest rate charged on the loan.

- Loan Tenure: The duration of the loan repayment in years or months.

- Repayment Frequency: Typically monthly, but other frequencies like bi-weekly or quarterly can be accommodated.

Accurate input is critical for reliable calculations. Errors in these parameters can significantly impact the results.

Accuracy and Speed

The accuracy of loan calculators is usually high, as they utilize precise algorithms. Speed is also generally very fast, as the calculations are often handled by optimized software. The speed and accuracy are usually not affected by the complexity of the calculations, since the computations are automated. This allows users to quickly explore various loan scenarios and compare options.

Loan Comparison Features

Advanced loan calculators allow users to compare different loan options. This can involve comparing loans with varying interest rates, loan terms, or other fees. The user can input different loan offers, and the calculator will display the total interest paid, total amount repaid, and projected monthly payments for each loan. This feature is particularly helpful when navigating multiple loan options.

Loan Repayment Options

| Repayment Option | Description |

|---|---|

| Equated Monthly Installments (EMIs) | Fixed monthly payments covering both interest and principal repayment, making repayment predictable. |

| Interest-only payments | Initially, only interest is paid, and the principal is repaid at the end of the loan term. |

| Balloon payments | Smaller monthly payments for most of the loan term, with a larger final payment (balloon payment). |

| Adjustable interest rates | Interest rates can change over the life of the loan, potentially affecting monthly payments. |

These different options offer flexibility in managing loan repayments, catering to varying financial situations and preferences.

User Interface and Experience

A student loan calculator or EMI app's success hinges significantly on its user interface. A well-designed interface not only makes the tool easy to use but also instills confidence in the user, encouraging them to explore the calculator's features and get the most accurate information possible. A poor interface, on the other hand, can deter users, leading to frustration and potentially inaccurate estimations.

A smooth user experience is paramount in this context.A user-friendly interface is crucial for student loan calculators because they often deal with complex calculations and potentially sensitive financial data. A well-structured interface ensures that users can navigate the calculator easily, input data accurately, and understand the results clearly. This fosters trust and encourages responsible financial planning.

Ideal User Interface Design

A well-designed student loan calculator should prioritize clarity and simplicity. Visual cues, like color-coding for different loan parameters (interest rates, repayment terms), can significantly improve comprehension. Intuitive navigation is also essential, allowing users to easily access different sections of the calculator without confusion. The use of clear labels and prompts is vital to guide users through the process.

Consistent formatting throughout the interface helps users quickly learn the tool's functionality.

Navigation and Tool Usage

Navigating student loan calculators effectively is critical. The layout should be logical, guiding users through the input process step-by-step. Clear instructions and tooltips should be available for each field, helping users understand the required data and its implications. For example, a loan calculator should clearly label fields for principal amount, interest rate, loan duration, and EMI frequency.

Users should easily find and access these sections. Interactive elements, such as drop-down menus and radio buttons, should be clearly marked and easy to use. Well-placed buttons for calculating and viewing results should be prominent and readily accessible.

Importance of Clear Information Presentation

The presentation of results in student loan calculators is critical. Data should be presented in a clear and concise format, avoiding complex formulas or technical jargon. Charts and graphs can be useful for visually representing repayment schedules and total interest paid. Clearly highlighting key metrics, such as total loan amount, monthly EMI, and total interest paid, enhances the user experience.

Results should be presented in multiple formats, such as tables and graphs, to cater to different learning styles. Providing clear explanations alongside the results is essential, especially for complex calculations or unexpected outcomes.

Improving User Experience with a Good Interface

A well-designed interface significantly improves the user experience. It fosters confidence and understanding, allowing users to make informed financial decisions. By presenting complex information in a simple and accessible manner, the calculator empowers users to manage their student loans effectively. An intuitive interface encourages users to explore different scenarios and compare various loan options, ultimately facilitating better financial planning.

Key Features of Different Interfaces

| Feature | Intuitive | Simple | Clear |

|---|---|---|---|

| Layout | Logical, organized flow; easy navigation | Straightforward structure; minimal clutter | Clear visual hierarchy; distinct sections |

| Input Fields | Self- labels; data validation | Few fields; direct entry | Clear labels; units specified |

| Results Display | Interactive graphs; detailed explanations | Summary of key data; easily readable | Charts; graphs; understandable format |

| Accessibility | Adaptable to different devices | Easy to use on any platform | Clear text; sufficient contrast |

Accuracy and Reliability of Loan Calculators

Student loan calculators are invaluable tools for prospective borrowers, providing estimates of monthly payments and total loan costs. However, the accuracy of these tools is crucial for informed decision-making. Understanding the factors that influence accuracy and potential pitfalls can help borrowers use these calculators effectively and avoid costly mistakes.The accuracy of a student loan calculator hinges on several factors, including the precision of input data and the assumptions underlying the calculations.

Borrowers must input precise information, like interest rates, loan amounts, and repayment terms, to get reliable results. Furthermore, the methodology used for calculating loan payments and interest accrual significantly affects the calculator's output.

Factors Affecting Accuracy

The accuracy of student loan calculators is dependent on various factors. Input data, including the interest rate, loan amount, and repayment period, are crucial. Errors in these figures directly impact the calculated results. For example, a slight discrepancy in the interest rate can lead to a considerable difference in the total loan cost. Furthermore, the loan repayment schedule (e.g., fixed monthly payments, variable payments) and compounding frequency play a critical role.

The type of loan (e.g., subsidized, unsubsidized, federal, private) also influences the calculation. Assumptions about future economic conditions, like inflation or changes in interest rates, can further impact accuracy, especially for long-term loans.

Common Errors and Pitfalls

Borrowers should be aware of potential pitfalls when using loan calculators. One common error is overlooking hidden fees or charges associated with the loan. These extra fees, which might not be immediately apparent, can significantly impact the overall cost of the loan. Additionally, borrowers should critically evaluate the loan terms and conditions, as calculators may not reflect all stipulations.

A lack of awareness about the specific loan terms and conditions can lead to inaccurate estimations. For instance, certain loan programs may have early repayment incentives or penalties that influence the loan's overall cost. Moreover, calculators often rely on fixed interest rates, which may not reflect the actual interest rates borrowers might experience in the market.

Verifying Calculator Accuracy

Verification of calculator accuracy is essential. Comparing results from multiple reputable calculators is a crucial step. Discrepancies between calculators should prompt further investigation into the source of the differences. For instance, reviewing the specific formulas and assumptions used in each calculator can help identify potential discrepancies. Furthermore, verifying the interest rates and fees displayed on the calculator with the lender's official documentation is recommended.

Checking for hidden charges, fees, and other stipulations can ensure the calculator's output aligns with the loan's actual terms.

Reliability Comparison of Calculators

The reliability of student loan calculators varies. Some calculators are more robust and accurate than others, often incorporating advanced algorithms and precise data inputs. Thorough research and reviews can help identify reliable calculators. However, relying solely on online reviews might not be sufficient; verifying the methodology and data sources used in the calculator is crucial. Furthermore, comparing the calculators' outputs for various scenarios can help assess their reliability.

For instance, testing them with varying interest rates and repayment periods can help identify which calculators are more accurate.

Potential Sources of Error in Loan Calculators

| Source of Error | Description |

|---|---|

| Inaccurate Input Data | Incorrect entry of interest rates, loan amounts, or repayment terms. |

| Hidden Fees and Charges | Omission of fees, penalties, or additional charges. |

| Simplified Loan Models | Calculators may not reflect complex loan structures or repayment options. |

| Assumption of Constant Interest Rates | Calculators may not account for fluctuations in interest rates over time. |

| Data Sources | Unreliable or outdated data sources for interest rates or fees. |

Comparison of Different Loan Calculator Tools

Choosing the right student loan calculator can be a game-changer in your financial planning. Navigating the diverse landscape of available tools can be daunting, but understanding their strengths and weaknesses is key to making an informed decision. This section delves into comparing various calculator tools, focusing on factors like usability, accuracy, and handling complex scenarios.

Comparison Table of Loan Calculator Tools

Different student loan calculators cater to varying needs and preferences. This table provides a concise overview of some common features and potential drawbacks:

| Calculator Tool | Pros | Cons |

|---|---|---|

| Tool A | Intuitive interface, quick calculations, handles various loan types | Limited advanced features, less precise calculations for complex scenarios |

| Tool B | Highly accurate calculations, comprehensive features, excellent support | Steeper learning curve, slightly more complex interface |

| Tool C | Free and readily available, simple to use, suitable for basic calculations | Lacks advanced features, limited customization options |

| Tool D | User-friendly interface, detailed explanations, extensive resources | May have a slower processing speed, fewer loan types supported |

Factors to Consider When Choosing a Loan Calculator

Several factors influence the optimal choice of a loan calculator. Carefully evaluating loan terms, interest rates, and associated fees is paramount.

- Loan Terms: Different calculators may handle varying loan terms (e.g., 10 years, 15 years) differently. A tool that accurately calculates monthly payments and total interest accrued across various repayment durations is essential. For instance, a 15-year loan will result in fewer payments but potentially higher monthly payments compared to a 10-year loan.

- Interest Rates: Interest rates significantly impact the overall cost of the loan. A calculator should accurately reflect the impact of different interest rates on the total loan amount and monthly payments. Consider calculators that allow for variable interest rates to prepare for potential changes in the market.

- Fees: Loan calculators should account for various fees, such as origination fees, prepayment penalties, and late payment charges. Accurate calculation of these fees is crucial for a realistic assessment of the loan's true cost.

Handling Complex Loan Scenarios

Some loan scenarios, such as those with variable interest rates, multiple loan types, or loan consolidation, require specialized calculators.

- Variable Interest Rates: Loan calculators should accurately reflect the impact of variable interest rates on monthly payments and total loan costs. Consider using calculators that allow input of various interest rate scenarios to predict potential outcomes.

- Multiple Loan Types: Some calculators may handle only one loan type at a time. Tools capable of calculating payments for multiple loan types simultaneously are beneficial. For example, a student might have both federal and private loans, which would be better calculated using a tool that accounts for both.

- Loan Consolidation: Loan consolidation can significantly impact monthly payments and the overall loan term. Use calculators that account for these changes, helping estimate the potential savings from consolidating.

User Review Comparison

User reviews can provide valuable insights into the strengths and weaknesses of different calculator tools.

| Calculator Tool | Positive Reviews | Negative Reviews |

|---|---|---|

| Tool A | Excellent accuracy, intuitive interface, quick calculations | Limited customization options, some bugs reported |

| Tool B | Highly accurate, comprehensive features, helpful support | Steep learning curve, interface could be more user-friendly |

| Tool C | Free, easy to use, good for basic calculations | Lacks advanced features, limited customization options |

| Tool D | Detailed explanations, user-friendly interface, helpful resources | Slower processing speed, fewer loan types supported |

Integration with Financial Planning: Student Loan Calculator Tools, Loan EMI Calculator Apps

Student loan calculators are more than just tools for figuring out monthly payments. They're crucial components of a comprehensive financial plan, enabling you to visualize the long-term implications of your borrowing decisions and strategically manage your finances. Understanding how these calculators integrate with other financial tools is key to maximizing their value.Integrating a student loan calculator into your broader financial strategy involves acknowledging the loan's impact on your overall budget and future goals.

This requires a proactive approach, incorporating repayment timelines into your long-term financial plans. It's not just about the monthly payment; it's about how that payment fits within your broader financial picture, including savings, investments, and other debts.

Importance of Repayment Timelines and Financial Goals

Student loan repayment timelines significantly affect your financial freedom. A shorter repayment period, while demanding, can lead to lower total interest paid and faster debt elimination. Conversely, a longer repayment period, though potentially more manageable initially, results in higher overall interest costs and a longer period of debt burden. Understanding these timelines allows for informed decisions about budgeting and saving strategies.

Equally important are your personal financial goals, such as buying a home, starting a family, or saving for retirement. Loan calculators help you see how your loan repayment fits into these broader goals, enabling you to adjust your strategies as needed.

Using Loan Calculators with Other Financial Tools, Student loan calculator tools, loan EMI calculator apps

Loan calculators can be effectively used in conjunction with other financial tools to create a holistic financial plan. For instance, linking a student loan calculator with a budget planner reveals how the loan payments affect your monthly spending capacity. Combining it with a retirement calculator helps assess how loan repayment impacts your ability to save for retirement. Similarly, integrating it with a savings goal calculator allows you to evaluate the potential impact on achieving specific financial objectives.

By correlating these tools, you can get a more comprehensive understanding of your financial situation.

Examples of Integration

Imagine you're planning to buy a house in five years. Using a student loan calculator, you can estimate your monthly payments. This allows you to factor in the loan's impact on your savings for a down payment and closing costs. Similarly, if you're targeting a specific investment goal, you can use the loan calculator to determine how the loan repayment timeline affects your investment strategy.

By linking the loan calculator with other tools, you can make informed decisions that align with your broader financial goals.

Role in Long-Term Financial Planning

Student loan calculators are indispensable tools for long-term financial planning. They enable you to understand the long-term financial implications of your student loan decisions. By visualizing the impact of different repayment strategies, you can develop a more robust financial plan that takes into account the burden of your student loan debt. This proactive approach enables you to effectively manage your debt, saving for future goals, and maximizing your financial well-being.

Utilizing Calculator Output

The output of a student loan calculator provides valuable data for integration with other financial tools. For example, knowing the projected monthly payment allows you to allocate funds appropriately within your budget. Furthermore, understanding the total interest paid over the loan's lifetime can inform investment strategies, helping you assess whether you can afford to invest a certain amount.

By leveraging this data, you can optimize your financial plan and achieve your long-term goals.

Practical Applications and Examples

Student loan calculators and EMI apps are invaluable tools for navigating the complexities of student loan repayment. They empower users to make informed decisions about their financial future by providing accurate estimations of loan costs, potential savings, and various repayment strategies. These tools are especially helpful for students and recent graduates facing significant debt burdens, helping them plan for the future.These tools aren't just for theoretical planning; they translate complex financial equations into easily digestible information.

This allows users to see the real-world implications of different choices and effectively manage their debt. By understanding how these tools work, you can make strategic adjustments to your financial plans.

Various Loan Scenarios

Student loan calculators excel in simulating different loan scenarios. This allows users to explore potential outcomes before committing to a specific repayment plan. This proactive approach is critical for avoiding unforeseen financial challenges.

- Scenario 1: Choosing a Repayment Plan: A student with a $50,000 loan can compare the impact of a standard repayment plan against an income-driven repayment plan. The calculator can show the total interest paid and the monthly payments for each option, aiding in the decision-making process. This comparison helps understand the long-term financial implications of each plan.

- Scenario 2: Impact of Interest Rates: A prospective student can explore the effect of different interest rates on their loan. For example, a $20,000 loan with a 6% interest rate will have a different monthly payment and total interest than the same loan with an 8% interest rate. This crucial analysis helps in understanding how interest rates directly influence the loan's overall cost.

- Scenario 3: Prepayment Strategies: A borrower can use the calculator to estimate the impact of extra payments. If a student can afford to pay an extra $100 per month on a $30,000 loan, the calculator will demonstrate how much faster the loan will be paid off, and how much interest will be saved.

Analyzing and Interpreting Results

Loan calculators provide comprehensive reports. Understanding these reports is essential for effective financial planning.

- Understanding Loan Terms: Calculators display key loan terms like interest rates, loan amounts, and repayment periods. This data, when interpreted properly, offers a clear picture of the loan's characteristics. For instance, recognizing a high-interest rate will prompt consideration of alternative financing options.

- Examining Repayment Schedules: The results often present a repayment schedule, showing the principal and interest paid each month. Visualizing this data helps in understanding the loan's trajectory and aids in budgeting.

- Interpreting Total Interest Paid: The calculators provide the total interest paid over the loan's lifetime. Comparing this figure across different scenarios helps determine the most cost-effective repayment plan. This analysis is crucial for budgeting and financial planning.

Adjusting Input Parameters

Loan calculators allow users to change input parameters to simulate different scenarios.

- Modifying Interest Rates: Users can adjust the interest rate to see how it impacts monthly payments and total interest. This sensitivity analysis allows for comparisons and informed decisions.

- Varying Loan Amounts: Changing the loan amount directly affects the monthly payments and total interest. This feature is useful for exploring different borrowing options and their consequences.

- Adjusting Repayment Periods: Adjusting the repayment period allows for comparison of shorter versus longer repayment plans. This helps in evaluating the trade-offs between monthly payments and total interest.

Loan Scenario Table

The following table illustrates the impact of different loan scenarios.

| Scenario | Loan Amount | Interest Rate | Repayment Period (Years) | Monthly Payment | Total Interest Paid |

|---|---|---|---|---|---|

| Standard Plan | $25,000 | 6.5% | 10 | $280 | $4,000 |

| Income-Driven Plan | $25,000 | 6.5% | 15 | $180 | $7,000 |

| Prepayment Plan | $25,000 | 6.5% | 7 | $350 | $2,000 |

Future Trends and Developments

Student loan calculators are evolving rapidly, driven by advancements in technology and the increasing complexity of financial landscapes. The future of these tools promises to be even more sophisticated, offering more personalized and insightful predictions for borrowers. This evolution is critical for empowering students and young adults to make informed financial decisions.

Potential Future Developments in Student Loan Calculator Technology

Future student loan calculators will likely incorporate more dynamic features, moving beyond simple calculations to provide comprehensive financial planning tools. This will involve considering various factors like potential salary increases, career paths, and personal circumstances. Advanced algorithms will adapt to individual situations, leading to more precise estimations of long-term loan burdens.

Improvements and Additions to Existing Tools

Existing tools often fall short in providing a holistic view of the borrower's financial future. Future calculators should incorporate interactive simulations of various career paths and salary projections. This would allow users to explore different scenarios and make more informed choices about loan amounts and repayment strategies. Integration with budgeting tools will allow users to track expenses and align their financial goals with their loan obligations.

Impact of Emerging Technologies on Loan Calculators

The integration of artificial intelligence (AI) and machine learning (ML) is transforming financial tools. AI-powered calculators can analyze vast datasets to identify trends and patterns in loan repayment behaviors, adjusting predictions and recommendations based on these insights. Machine learning algorithms can also personalize user experiences, suggesting loan options and repayment strategies tailored to individual circumstances. For example, an AI-powered calculator might analyze a user's academic performance, chosen field of study, and expected job market trends to provide more accurate predictions about future earnings.

Integration of AI or Machine Learning in Student Loan Calculators

AI and machine learning will enable student loan calculators to analyze a broader range of data, including educational choices, employment trends, and economic indicators. This data can be used to predict potential earnings and to provide personalized recommendations. For example, a calculator could factor in the specific skills developed during the student's education and match them to emerging job markets to provide a more accurate prediction of future earning potential.

The use of AI could also enable the tool to detect and flag potential financial pitfalls, such as high-interest rates or unfavorable loan terms.

Changes in User Experience with Future Technologies

The user experience of student loan calculators will become more intuitive and personalized. Interactive graphs and visualizations will make it easier to understand complex financial data and scenarios. The user interface will be more responsive and adaptive, adjusting to the individual user's needs and preferences. Calculators will be able to predict future economic conditions and loan interest rate fluctuations, enabling users to plan accordingly.

Users will have a clearer picture of the long-term financial implications of their choices, enabling them to make informed decisions about borrowing.

Closing Summary

In conclusion, student loan calculator tools and loan EMI calculator apps are indispensable resources for anyone considering or managing student loans. These tools provide a clear, concise, and comparative view of available options, allowing for informed decisions regarding loan terms and repayment strategies. From understanding loan parameters to integrating these calculators into broader financial planning, these tools empower users to take control of their financial futures.

Future developments, such as AI integration, promise to further enhance the capabilities and user experience of these crucial financial planning tools.