Functionality and Features of Loan Calculators

Student loan calculators and apps have become indispensable tools for aspiring students and those already in debt. These tools simplify the often complex process of understanding and managing student loan repayments. Beyond simply providing a figure, the best calculators offer insights into various repayment strategies, empowering users to make informed decisions.Loan calculators go beyond basic EMI calculations. They often provide a comprehensive overview of the loan, including the total interest paid, the total amount repaid, and projections for the entire loan tenure.

This allows users to effectively compare different loan options, factors like interest rates, and loan terms.

Common Functionalities of Loan EMI Calculators

Loan EMI calculators typically calculate monthly payments based on the principal loan amount, interest rate, and loan tenure. The fundamental calculation involves a complex formula that considers compounding interest over time. This means the interest charged on the loan changes as the loan is repaid. The most commonly used formula for calculating monthly EMI is the following:

EMI = [P x R x (1+R)^N]/[(1+R)^N-1]

Where:

- P = Principal loan amount

- R = Monthly interest rate (annual interest rate divided by 12)

- N = Total number of monthly installments

Calculation Methodology

The calculations behind loan EMI calculators are built on the concept of amortized loans. This means the loan amount is repaid in equal installments over a set period, and each installment covers both interest and principal repayment. The interest component of each EMI is calculated on the outstanding principal balance. As the loan is repaid, the outstanding principal balance decreases, and the interest component of subsequent EMIs also decreases.

Input Parameters

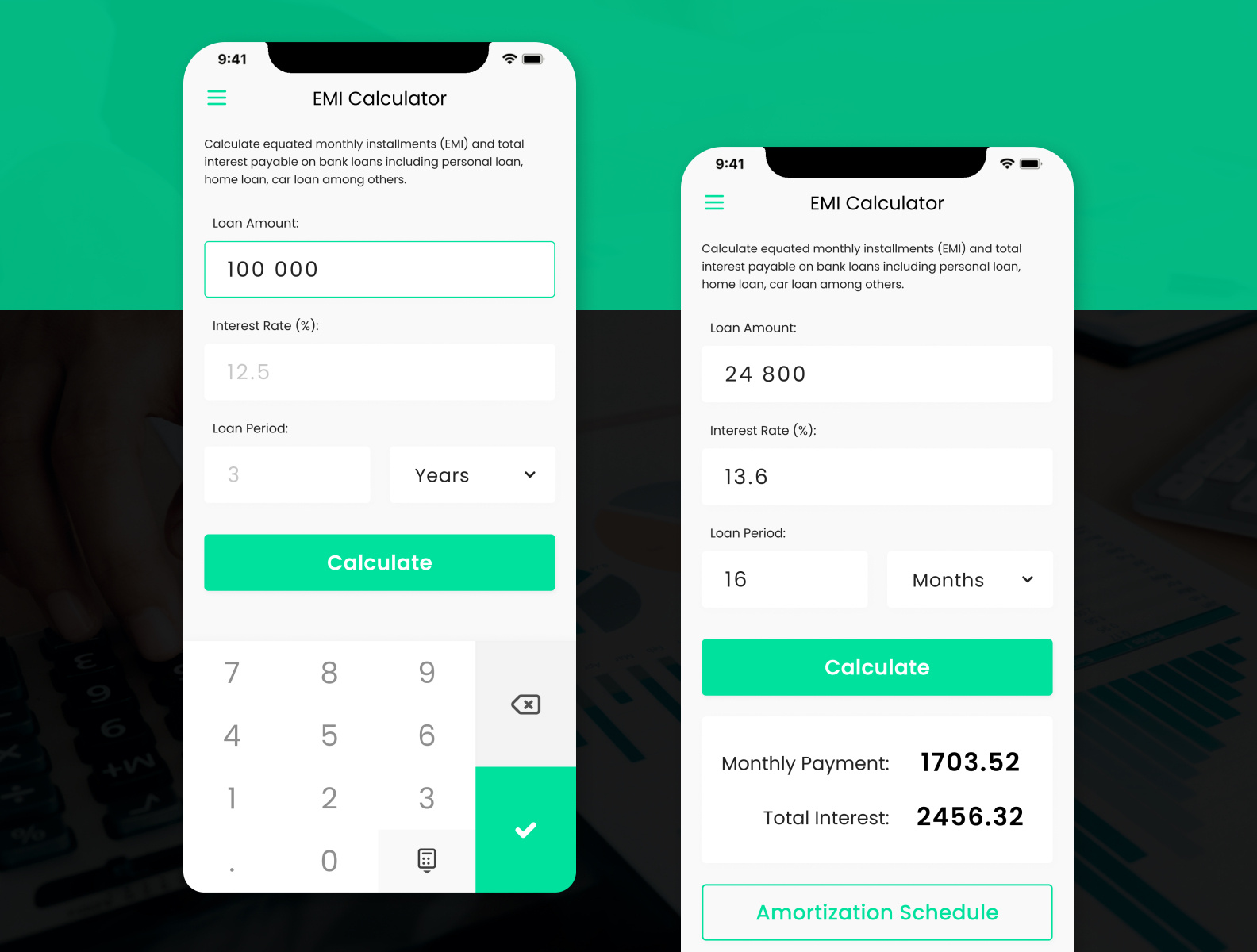

These calculators require specific input parameters to function correctly. The key inputs include:

- Principal Loan Amount: The total amount borrowed.

- Interest Rate: The annual interest rate charged on the loan.

- Loan Tenure: The duration of the loan repayment in years or months.

- Repayment Frequency: Typically monthly, but other frequencies like bi-weekly or quarterly can be accommodated.

Accurate input is critical for reliable calculations. Errors in these parameters can significantly impact the results.