Accuracy and Speed

The accuracy of loan calculators is usually high, as they utilize precise algorithms. Speed is also generally very fast, as the calculations are often handled by optimized software. The speed and accuracy are usually not affected by the complexity of the calculations, since the computations are automated. This allows users to quickly explore various loan scenarios and compare options.

Loan Comparison Features

Advanced loan calculators allow users to compare different loan options. This can involve comparing loans with varying interest rates, loan terms, or other fees. The user can input different loan offers, and the calculator will display the total interest paid, total amount repaid, and projected monthly payments for each loan. This feature is particularly helpful when navigating multiple loan options.

Loan Repayment Options

| Repayment Option | Description |

|---|---|

| Equated Monthly Installments (EMIs) | Fixed monthly payments covering both interest and principal repayment, making repayment predictable. |

| Interest-only payments | Initially, only interest is paid, and the principal is repaid at the end of the loan term. |

| Balloon payments | Smaller monthly payments for most of the loan term, with a larger final payment (balloon payment). |

| Adjustable interest rates | Interest rates can change over the life of the loan, potentially affecting monthly payments. |

These different options offer flexibility in managing loan repayments, catering to varying financial situations and preferences.

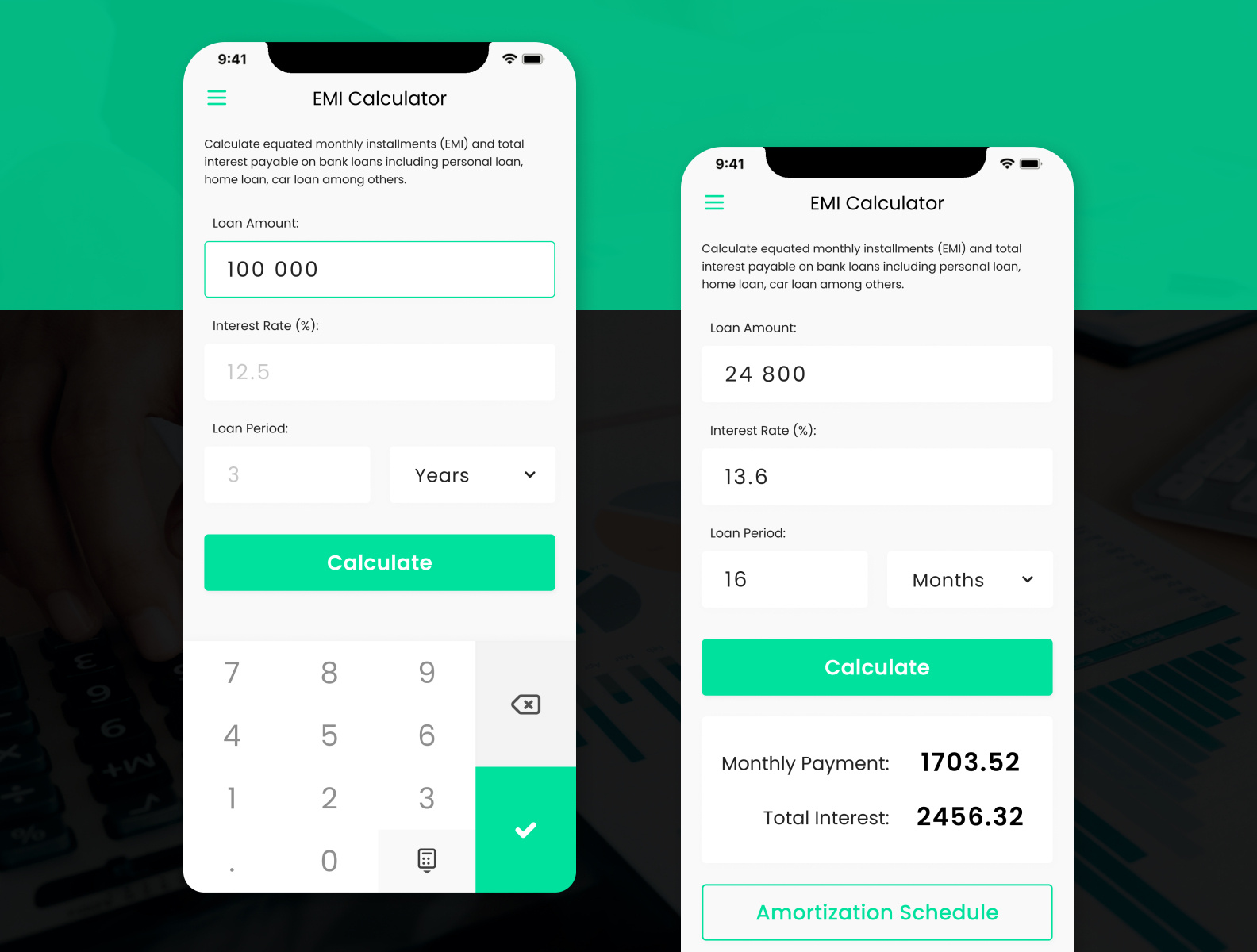

User Interface and Experience

A student loan calculator or EMI app’s success hinges significantly on its user interface. A well-designed interface not only makes the tool easy to use but also instills confidence in the user, encouraging them to explore the calculator’s features and get the most accurate information possible. A poor interface, on the other hand, can deter users, leading to frustration and potentially inaccurate estimations.

A smooth user experience is paramount in this context.A user-friendly interface is crucial for student loan calculators because they often deal with complex calculations and potentially sensitive financial data. A well-structured interface ensures that users can navigate the calculator easily, input data accurately, and understand the results clearly. This fosters trust and encourages responsible financial planning.

Ideal User Interface Design

A well-designed student loan calculator should prioritize clarity and simplicity. Visual cues, like color-coding for different loan parameters (interest rates, repayment terms), can significantly improve comprehension. Intuitive navigation is also essential, allowing users to easily access different sections of the calculator without confusion. The use of clear labels and prompts is vital to guide users through the process.

Consistent formatting throughout the interface helps users quickly learn the tool’s functionality.

Navigation and Tool Usage

Navigating student loan calculators effectively is critical. The layout should be logical, guiding users through the input process step-by-step. Clear instructions and tooltips should be available for each field, helping users understand the required data and its implications. For example, a loan calculator should clearly label fields for principal amount, interest rate, loan duration, and EMI frequency.