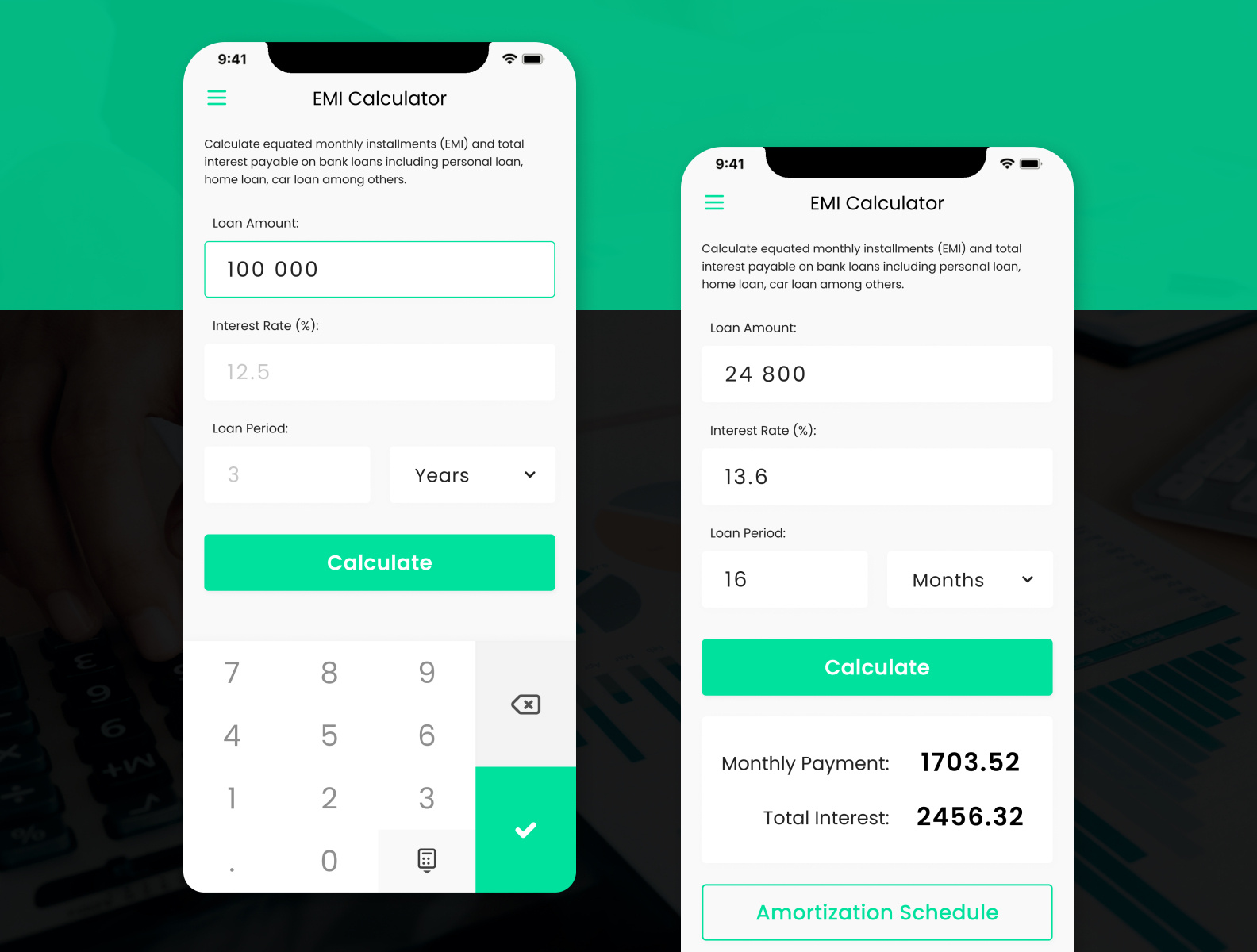

Users should easily find and access these sections. Interactive elements, such as drop-down menus and radio buttons, should be clearly marked and easy to use. Well-placed buttons for calculating and viewing results should be prominent and readily accessible.

Importance of Clear Information Presentation

The presentation of results in student loan calculators is critical. Data should be presented in a clear and concise format, avoiding complex formulas or technical jargon. Charts and graphs can be useful for visually representing repayment schedules and total interest paid. Clearly highlighting key metrics, such as total loan amount, monthly EMI, and total interest paid, enhances the user experience.

Results should be presented in multiple formats, such as tables and graphs, to cater to different learning styles. Providing clear explanations alongside the results is essential, especially for complex calculations or unexpected outcomes.

Improving User Experience with a Good Interface

A well-designed interface significantly improves the user experience. It fosters confidence and understanding, allowing users to make informed financial decisions. By presenting complex information in a simple and accessible manner, the calculator empowers users to manage their student loans effectively. An intuitive interface encourages users to explore different scenarios and compare various loan options, ultimately facilitating better financial planning.

Key Features of Different Interfaces

| Feature | Intuitive | Simple | Clear |

|---|---|---|---|

| Layout | Logical, organized flow; easy navigation | Straightforward structure; minimal clutter | Clear visual hierarchy; distinct sections |

| Input Fields | Self- labels; data validation | Few fields; direct entry | Clear labels; units specified |

| Results Display | Interactive graphs; detailed explanations | Summary of key data; easily readable | Charts; graphs; understandable format |

| Accessibility | Adaptable to different devices | Easy to use on any platform | Clear text; sufficient contrast |

Accuracy and Reliability of Loan Calculators

Student loan calculators are invaluable tools for prospective borrowers, providing estimates of monthly payments and total loan costs. However, the accuracy of these tools is crucial for informed decision-making. Understanding the factors that influence accuracy and potential pitfalls can help borrowers use these calculators effectively and avoid costly mistakes.The accuracy of a student loan calculator hinges on several factors, including the precision of input data and the assumptions underlying the calculations.

Borrowers must input precise information, like interest rates, loan amounts, and repayment terms, to get reliable results. Furthermore, the methodology used for calculating loan payments and interest accrual significantly affects the calculator’s output.

Factors Affecting Accuracy

The accuracy of student loan calculators is dependent on various factors. Input data, including the interest rate, loan amount, and repayment period, are crucial. Errors in these figures directly impact the calculated results. For example, a slight discrepancy in the interest rate can lead to a considerable difference in the total loan cost. Furthermore, the loan repayment schedule (e.g., fixed monthly payments, variable payments) and compounding frequency play a critical role.

The type of loan (e.g., subsidized, unsubsidized, federal, private) also influences the calculation. Assumptions about future economic conditions, like inflation or changes in interest rates, can further impact accuracy, especially for long-term loans.