| Calculator Tool | Pros | Cons |

|---|---|---|

| Tool A | Intuitive interface, quick calculations, handles various loan types | Limited advanced features, less precise calculations for complex scenarios |

| Tool B | Highly accurate calculations, comprehensive features, excellent support | Steeper learning curve, slightly more complex interface |

| Tool C | Free and readily available, simple to use, suitable for basic calculations | Lacks advanced features, limited customization options |

| Tool D | User-friendly interface, detailed explanations, extensive resources | May have a slower processing speed, fewer loan types supported |

Factors to Consider When Choosing a Loan Calculator

Several factors influence the optimal choice of a loan calculator. Carefully evaluating loan terms, interest rates, and associated fees is paramount.

- Loan Terms: Different calculators may handle varying loan terms (e.g., 10 years, 15 years) differently. A tool that accurately calculates monthly payments and total interest accrued across various repayment durations is essential. For instance, a 15-year loan will result in fewer payments but potentially higher monthly payments compared to a 10-year loan.

- Interest Rates: Interest rates significantly impact the overall cost of the loan. A calculator should accurately reflect the impact of different interest rates on the total loan amount and monthly payments. Consider calculators that allow for variable interest rates to prepare for potential changes in the market.

- Fees: Loan calculators should account for various fees, such as origination fees, prepayment penalties, and late payment charges. Accurate calculation of these fees is crucial for a realistic assessment of the loan’s true cost.

Handling Complex Loan Scenarios

Some loan scenarios, such as those with variable interest rates, multiple loan types, or loan consolidation, require specialized calculators.

- Variable Interest Rates: Loan calculators should accurately reflect the impact of variable interest rates on monthly payments and total loan costs. Consider using calculators that allow input of various interest rate scenarios to predict potential outcomes.

- Multiple Loan Types: Some calculators may handle only one loan type at a time. Tools capable of calculating payments for multiple loan types simultaneously are beneficial. For example, a student might have both federal and private loans, which would be better calculated using a tool that accounts for both.

- Loan Consolidation: Loan consolidation can significantly impact monthly payments and the overall loan term. Use calculators that account for these changes, helping estimate the potential savings from consolidating.

User Review Comparison

User reviews can provide valuable insights into the strengths and weaknesses of different calculator tools.

| Calculator Tool | Positive Reviews | Negative Reviews |

|---|---|---|

| Tool A | Excellent accuracy, intuitive interface, quick calculations | Limited customization options, some bugs reported |

| Tool B | Highly accurate, comprehensive features, helpful support | Steep learning curve, interface could be more user-friendly |

| Tool C | Free, easy to use, good for basic calculations | Lacks advanced features, limited customization options |

| Tool D | Detailed explanations, user-friendly interface, helpful resources | Slower processing speed, fewer loan types supported |

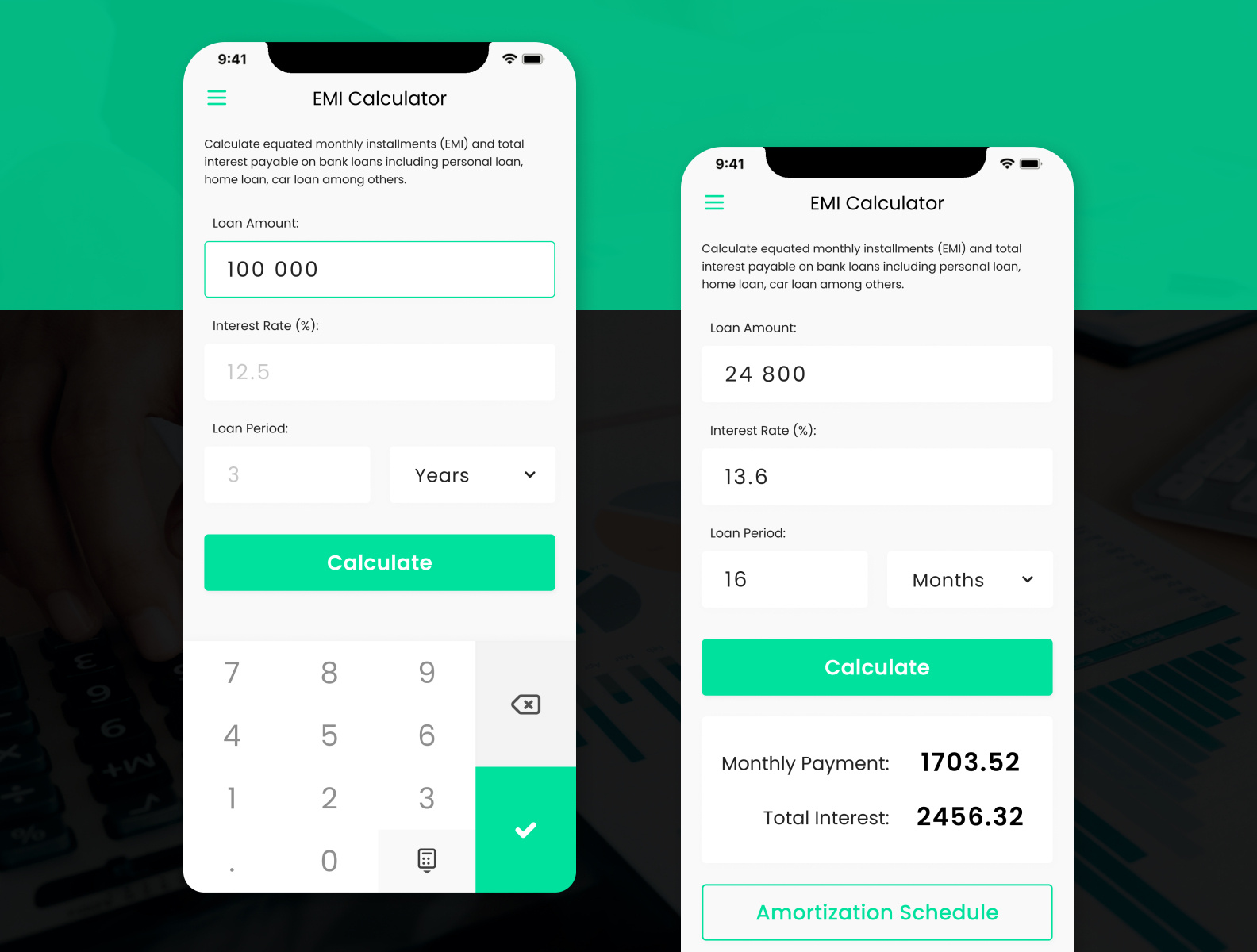

Integration with Financial Planning: Student Loan Calculator Tools, Loan EMI Calculator Apps

Student loan calculators are more than just tools for figuring out monthly payments. They’re crucial components of a comprehensive financial plan, enabling you to visualize the long-term implications of your borrowing decisions and strategically manage your finances. Understanding how these calculators integrate with other financial tools is key to maximizing their value.Integrating a student loan calculator into your broader financial strategy involves acknowledging the loan’s impact on your overall budget and future goals.

This requires a proactive approach, incorporating repayment timelines into your long-term financial plans. It’s not just about the monthly payment; it’s about how that payment fits within your broader financial picture, including savings, investments, and other debts.

Importance of Repayment Timelines and Financial Goals

Student loan repayment timelines significantly affect your financial freedom. A shorter repayment period, while demanding, can lead to lower total interest paid and faster debt elimination. Conversely, a longer repayment period, though potentially more manageable initially, results in higher overall interest costs and a longer period of debt burden. Understanding these timelines allows for informed decisions about budgeting and saving strategies.

Equally important are your personal financial goals, such as buying a home, starting a family, or saving for retirement. Loan calculators help you see how your loan repayment fits into these broader goals, enabling you to adjust your strategies as needed.

Using Loan Calculators with Other Financial Tools, Student loan calculator tools, loan EMI calculator apps

Loan calculators can be effectively used in conjunction with other financial tools to create a holistic financial plan. For instance, linking a student loan calculator with a budget planner reveals how the loan payments affect your monthly spending capacity. Combining it with a retirement calculator helps assess how loan repayment impacts your ability to save for retirement. Similarly, integrating it with a savings goal calculator allows you to evaluate the potential impact on achieving specific financial objectives.