By correlating these tools, you can get a more comprehensive understanding of your financial situation.

Examples of Integration

Imagine you’re planning to buy a house in five years. Using a student loan calculator, you can estimate your monthly payments. This allows you to factor in the loan’s impact on your savings for a down payment and closing costs. Similarly, if you’re targeting a specific investment goal, you can use the loan calculator to determine how the loan repayment timeline affects your investment strategy.

By linking the loan calculator with other tools, you can make informed decisions that align with your broader financial goals.

Role in Long-Term Financial Planning

Student loan calculators are indispensable tools for long-term financial planning. They enable you to understand the long-term financial implications of your student loan decisions. By visualizing the impact of different repayment strategies, you can develop a more robust financial plan that takes into account the burden of your student loan debt. This proactive approach enables you to effectively manage your debt, saving for future goals, and maximizing your financial well-being.

Utilizing Calculator Output

The output of a student loan calculator provides valuable data for integration with other financial tools. For example, knowing the projected monthly payment allows you to allocate funds appropriately within your budget. Furthermore, understanding the total interest paid over the loan’s lifetime can inform investment strategies, helping you assess whether you can afford to invest a certain amount.

By leveraging this data, you can optimize your financial plan and achieve your long-term goals.

Practical Applications and Examples

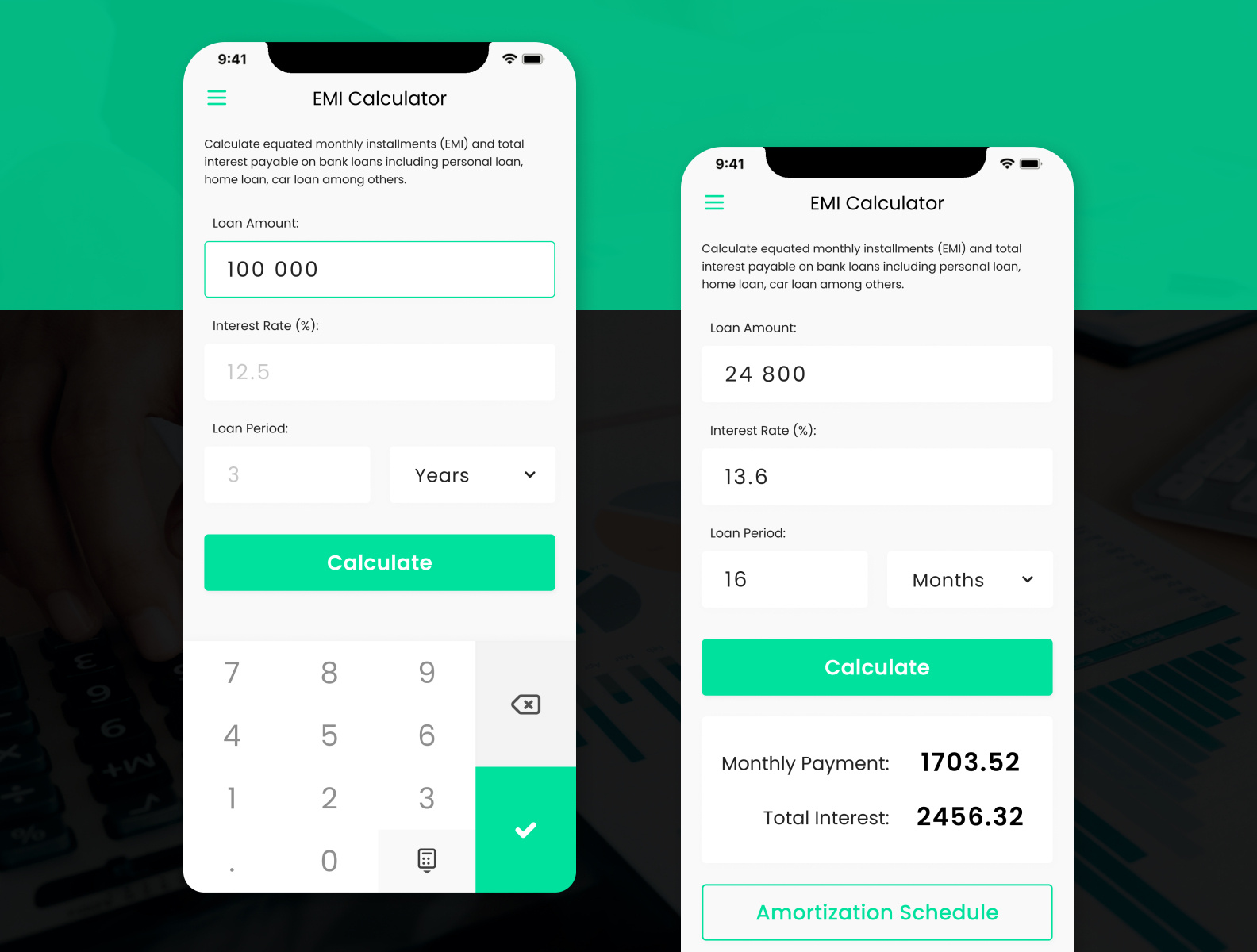

Student loan calculators and EMI apps are invaluable tools for navigating the complexities of student loan repayment. They empower users to make informed decisions about their financial future by providing accurate estimations of loan costs, potential savings, and various repayment strategies. These tools are especially helpful for students and recent graduates facing significant debt burdens, helping them plan for the future.These tools aren’t just for theoretical planning; they translate complex financial equations into easily digestible information.

This allows users to see the real-world implications of different choices and effectively manage their debt. By understanding how these tools work, you can make strategic adjustments to your financial plans.