Various Loan Scenarios

Student loan calculators excel in simulating different loan scenarios. This allows users to explore potential outcomes before committing to a specific repayment plan. This proactive approach is critical for avoiding unforeseen financial challenges.

- Scenario 1: Choosing a Repayment Plan: A student with a $50,000 loan can compare the impact of a standard repayment plan against an income-driven repayment plan. The calculator can show the total interest paid and the monthly payments for each option, aiding in the decision-making process. This comparison helps understand the long-term financial implications of each plan.

- Scenario 2: Impact of Interest Rates: A prospective student can explore the effect of different interest rates on their loan. For example, a $20,000 loan with a 6% interest rate will have a different monthly payment and total interest than the same loan with an 8% interest rate. This crucial analysis helps in understanding how interest rates directly influence the loan’s overall cost.

- Scenario 3: Prepayment Strategies: A borrower can use the calculator to estimate the impact of extra payments. If a student can afford to pay an extra $100 per month on a $30,000 loan, the calculator will demonstrate how much faster the loan will be paid off, and how much interest will be saved.

Analyzing and Interpreting Results

Loan calculators provide comprehensive reports. Understanding these reports is essential for effective financial planning.

- Understanding Loan Terms: Calculators display key loan terms like interest rates, loan amounts, and repayment periods. This data, when interpreted properly, offers a clear picture of the loan’s characteristics. For instance, recognizing a high-interest rate will prompt consideration of alternative financing options.

- Examining Repayment Schedules: The results often present a repayment schedule, showing the principal and interest paid each month. Visualizing this data helps in understanding the loan’s trajectory and aids in budgeting.

- Interpreting Total Interest Paid: The calculators provide the total interest paid over the loan’s lifetime. Comparing this figure across different scenarios helps determine the most cost-effective repayment plan. This analysis is crucial for budgeting and financial planning.

Adjusting Input Parameters

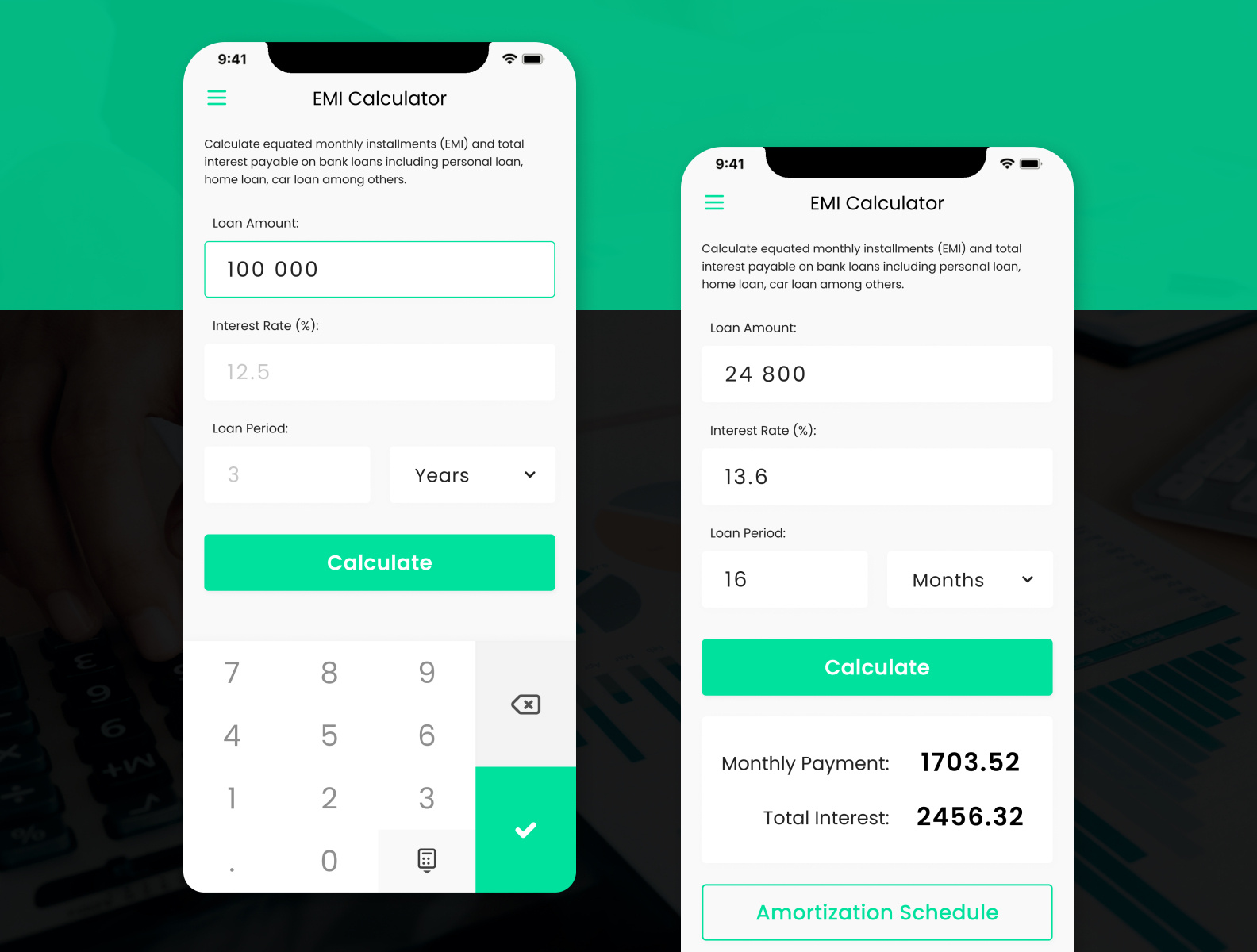

Loan calculators allow users to change input parameters to simulate different scenarios.

- Modifying Interest Rates: Users can adjust the interest rate to see how it impacts monthly payments and total interest. This sensitivity analysis allows for comparisons and informed decisions.

- Varying Loan Amounts: Changing the loan amount directly affects the monthly payments and total interest. This feature is useful for exploring different borrowing options and their consequences.

- Adjusting Repayment Periods: Adjusting the repayment period allows for comparison of shorter versus longer repayment plans. This helps in evaluating the trade-offs between monthly payments and total interest.

Loan Scenario Table

The following table illustrates the impact of different loan scenarios.

| Scenario | Loan Amount | Interest Rate | Repayment Period (Years) | Monthly Payment | Total Interest Paid |

|---|---|---|---|---|---|

| Standard Plan | $25,000 | 6.5% | 10 | $280 | $4,000 |

| Income-Driven Plan | $25,000 | 6.5% | 15 | $180 | $7,000 |

| Prepayment Plan | $25,000 | 6.5% | 7 | $350 | $2,000 |

Future Trends and Developments

Student loan calculators are evolving rapidly, driven by advancements in technology and the increasing complexity of financial landscapes. The future of these tools promises to be even more sophisticated, offering more personalized and insightful predictions for borrowers. This evolution is critical for empowering students and young adults to make informed financial decisions.

Potential Future Developments in Student Loan Calculator Technology

Future student loan calculators will likely incorporate more dynamic features, moving beyond simple calculations to provide comprehensive financial planning tools. This will involve considering various factors like potential salary increases, career paths, and personal circumstances. Advanced algorithms will adapt to individual situations, leading to more precise estimations of long-term loan burdens.

Improvements and Additions to Existing Tools

Existing tools often fall short in providing a holistic view of the borrower’s financial future. Future calculators should incorporate interactive simulations of various career paths and salary projections. This would allow users to explore different scenarios and make more informed choices about loan amounts and repayment strategies. Integration with budgeting tools will allow users to track expenses and align their financial goals with their loan obligations.