Impact of Emerging Technologies on Loan Calculators

The integration of artificial intelligence (AI) and machine learning (ML) is transforming financial tools. AI-powered calculators can analyze vast datasets to identify trends and patterns in loan repayment behaviors, adjusting predictions and recommendations based on these insights. Machine learning algorithms can also personalize user experiences, suggesting loan options and repayment strategies tailored to individual circumstances. For example, an AI-powered calculator might analyze a user’s academic performance, chosen field of study, and expected job market trends to provide more accurate predictions about future earnings.

Integration of AI or Machine Learning in Student Loan Calculators

AI and machine learning will enable student loan calculators to analyze a broader range of data, including educational choices, employment trends, and economic indicators. This data can be used to predict potential earnings and to provide personalized recommendations. For example, a calculator could factor in the specific skills developed during the student’s education and match them to emerging job markets to provide a more accurate prediction of future earning potential.

The use of AI could also enable the tool to detect and flag potential financial pitfalls, such as high-interest rates or unfavorable loan terms.

Changes in User Experience with Future Technologies

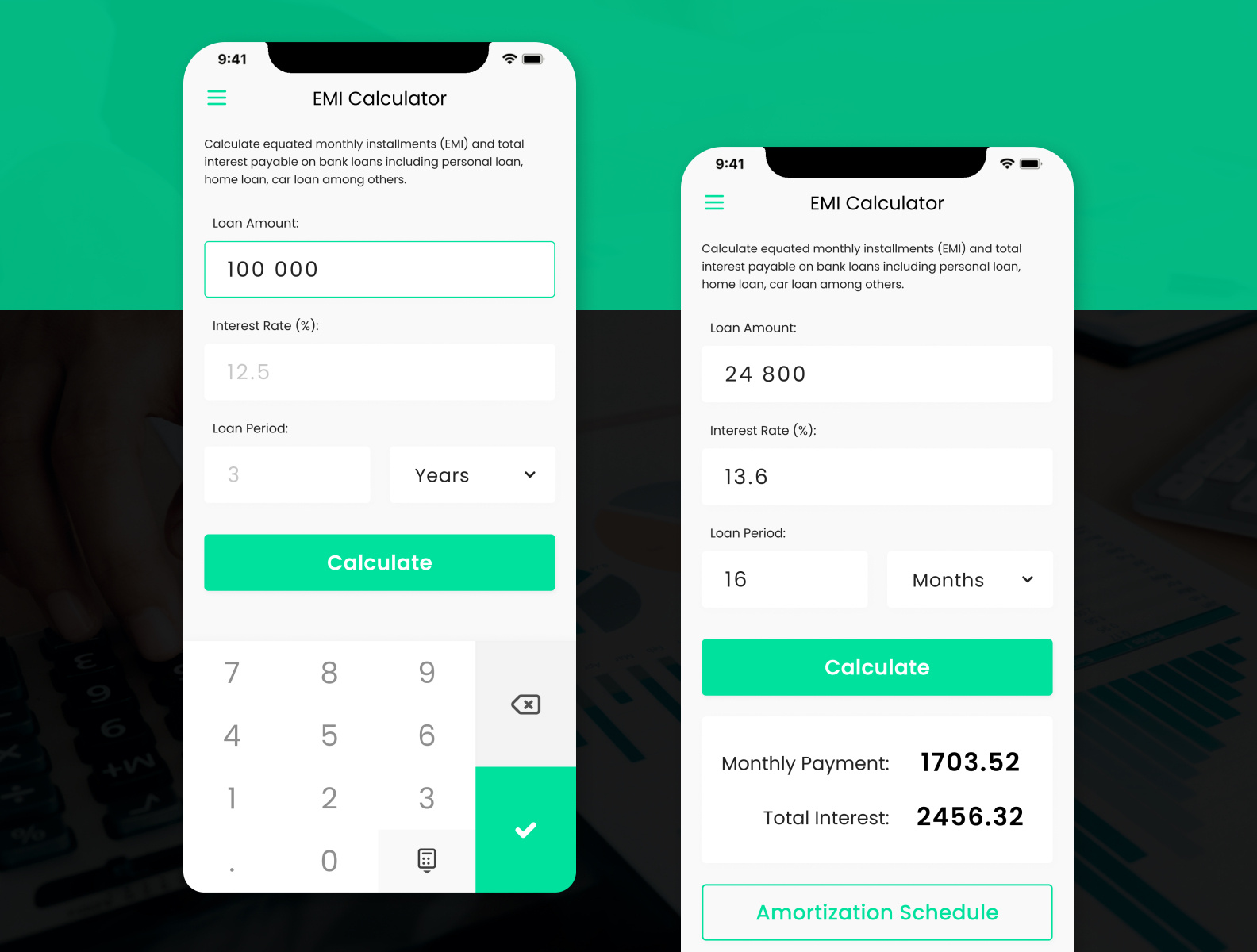

The user experience of student loan calculators will become more intuitive and personalized. Interactive graphs and visualizations will make it easier to understand complex financial data and scenarios. The user interface will be more responsive and adaptive, adjusting to the individual user’s needs and preferences. Calculators will be able to predict future economic conditions and loan interest rate fluctuations, enabling users to plan accordingly.

Users will have a clearer picture of the long-term financial implications of their choices, enabling them to make informed decisions about borrowing.

Closing Summary

In conclusion, student loan calculator tools and loan EMI calculator apps are indispensable resources for anyone considering or managing student loans. These tools provide a clear, concise, and comparative view of available options, allowing for informed decisions regarding loan terms and repayment strategies. From understanding loan parameters to integrating these calculators into broader financial planning, these tools empower users to take control of their financial futures.

Future developments, such as AI integration, promise to further enhance the capabilities and user experience of these crucial financial planning tools.